The Tax Report is one of the core monthly reports in the Hyper Aurest system. It provides an accurate summary of all taxes incurred from sales and purchases within a specified period. This report is essential for reviewing due taxes and assisting management in preparing official tax statements with full transparency and precision.

✅ What is the Tax Report?

It is a report that displays the details of taxes calculated on both sales and purchases within the business, including:

-

Sales Tax (Value Added Tax)

-

Excise Tax (if applicable)

-

Total sales and purchases during the selected period

✳ This report is used to analyze tax obligations and ensure compliance with local financial and tax regulations.

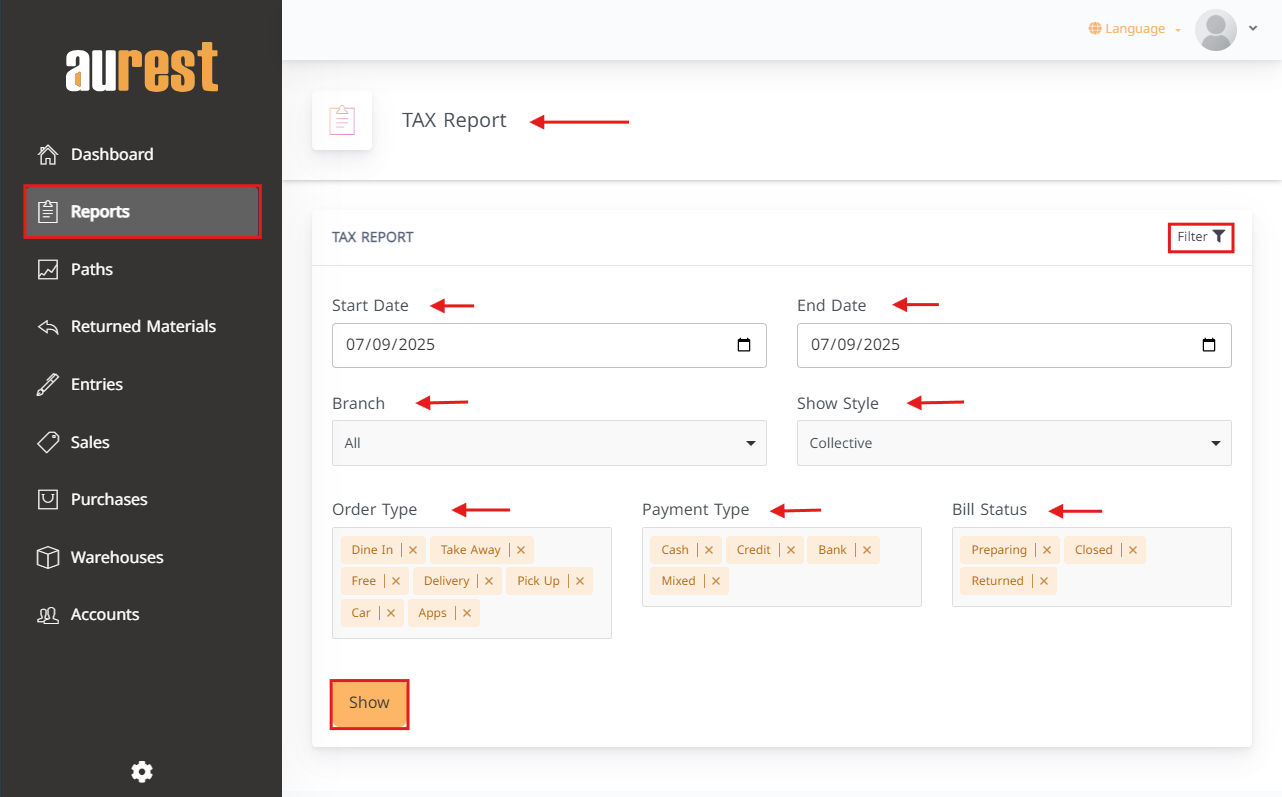

✅ Available Filter Options in the Report

The system allows you to customize the report output through a set of flexible filters, including:

-

Time Period: From Start Date – To End Date

-

Branch: To specify a particular branch

-

View Mode:

-

Collective: Displays aggregated values

-

Detailed: (if available) Displays each invoice or tax transaction

-

-

Order Type: Dine-in, Takeaway, Delivery, Hospitality, Incoming, Drive-thru, Apps

-

Payment Type: Cash, Credit, Card, Shared

-

Bill Status: Processing, Closed, Returned

✳ After selecting the desired filters, click the "Show" button to display the results instantly.

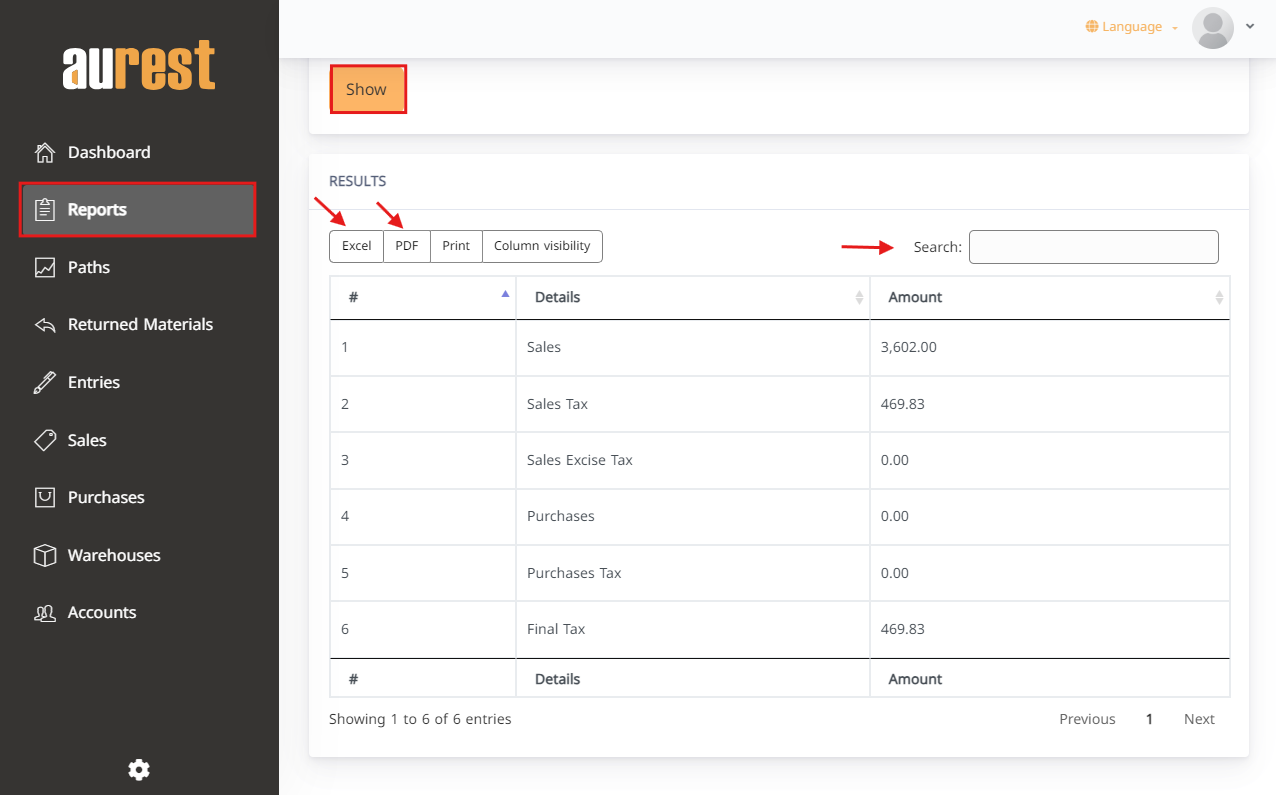

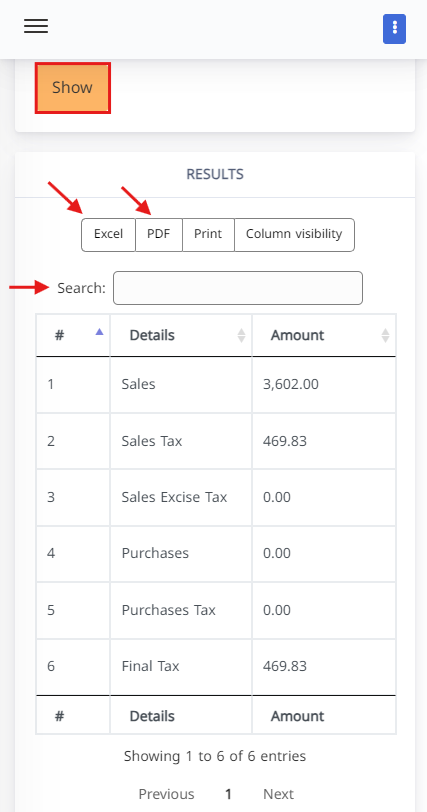

✅ Report Contents

The report provides comprehensive data, including:

-

Total sales during the period

-

Value of sales tax

-

Value of excise tax (if applicable)

-

Total purchases

-

Value of purchase tax

-

Net tax amount (Net payable tax = sales tax collected – purchase tax paid)

✳ The report can be exported to Excel or PDF, or printed directly for easy reference.

✅ When Should You Use This Report?

-

When preparing monthly or quarterly tax declarations

-

To review tax obligations for each branch

-

To analyze the tax impact on overall profit

-

To reconcile system-calculated taxes with those of your accountant or tax authority

⭐ Summary

The Tax Report in Hyper Aurest offers a precise and user-friendly tool to monitor sales and purchase taxes. It enhances transparency in financial management and ensures full compliance with legal and tax requirements—effortlessly and professionally

العربية

العربية